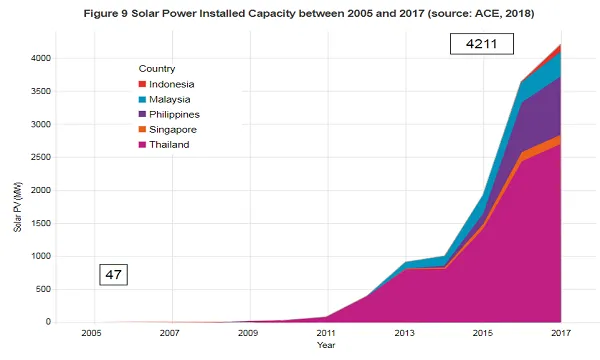

ASEAN solar capacity grew to 4.21GW in 2007-2017

The installations of solar PV in Thailand jumped from 32MW in 2007 to 2,697MW in 2017.

The solar power installed capacity in the 10 ASEAN member states (AMS) increased significantly between 2007 and 2017, from around 47MW to 4,211MW with Thailand, the Philippines, and Malaysia as the leading countries, according to a report published by the ASEAN Centre for Energy (ACE) and Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH.

The installations of solar PV in Thailand increased from 32MW in 2007 to 2,697MW in 2017, while those in the Philippines and Malaysia increased from 1 MW and 7.0 MW to 885.3 MW and 362.2 MW, respectively, the report noted.

However, during the same period, Myanmar and Vietnam had not yet installed any solar PV.

Along with the increases in installed capacity, the electricity generated by solar PV in the ASEAN grew in the same proportion from 58GWh in 2007 to 5,004GWh in 2016. The electricity generation from solar PV amongst the three leading AMS comprising of Thailand, the Philippines, and Malaysia increased from 39GWh, 1GWh, and 8.6 GWh, respectively, in 2007 to 3,377 GWh, 1,097 GWh, and 323.4 GWh, respectively, in 2016.

In terms of the solar PV projects in ASEAN, the report covered 46 solar PV plants in five AMS. The projects were grouped by their installed capacities into three groups: less than 100kW (small), 100–1,000kW (medium), and 1,000kW or more (large).

The country-average capacity factors, which ranged from 11% to 21%, of the solar PV plants included in the study of small, medium, and large-scale plants was about 16%, data showed.

The installation costs of the solar PV power plants varied according to the capacity and type of technology, with the capacity-weighted averages of the installation costs of the solar PV plants reaching $1,963, $1,824, and $2,013/kW for small, medium, and large scale, respectively.

The operation and maintenance (O&M) costs ranged from about 0.23% to 3.63%, 0.02% to 4.44%, and 0.01% to 4.95% of capex for the small-, medium-, and large-scale projects, respectively. On average, for all scales, the O&M costs were about 1% of capex and were not significantly different according to system size. The O&M costs of some of the large PV plants in the Philippines reached up to 5%, which is quite unusual for PV power plants, the report’s authors noted.

“Based on calculations, the levelised cost of electricity (LCOE) of solar PV plants in the AMS ranged from $0.099 to $0.2/kWh. The largest and smallest calculated LCOEs were both from the small-scale plants,” the authors highlighted. “On average, the small-, medium-, and large-scale solar PV plants had an LCOE of $0.187, $0.181, and $0.182/kWh, respectively. Most of the solar PV plants in the ASEAN countries were installed in the six years after 2012.”

Compared to the globally weighted average, the LCOE of utility-scale solar PV decreased to $0.10/kWh in 2017, with the LCOE for 2025 projected at $0.147/kWh, they added.

According to ACE and GIZ’s sensitivity analysis, which studied key parameters of a project that caused the largest changes to LCOE such as installed capacity and O&M costs, a 50% increase in the discount rate resulted in a 36% increase in the LCOE, whilst a decrease resulted in a 32% decrease in the LCOE.

“A 50% increase in O&M costs resulted in a 4% increase in the LCOE, whilst inversely, a 50%

decrease in O&M costs resulted in a 4% decrease in the LCOE. A 50% increase in capital costs resulted in a 46% increase in the LCOE, whilst a 50% decrease in capital cost resulted in a 46% decrease in the LCOE,” the authors explained.

The capacity factor was also found to be inversely related to the LCOE, with a 50% increase in the capacity factor resulting in a 33% decrease in LCOE, whilst a 50% decrease in the capacity factor resulted in a 100% increase in the LCOE. For annual module degradation, a 50% increase in the reference value resulted in an increase of 2% in the LCOE.

“In sum, three main important parameters for solar PV technology are: capacity factor, discount rate, and capital costs. These three affect the LCOE more than any other parameter and thus should be the focus in future renewable energy (RE) development.

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

![Cross Domain [SBR + ABR]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/pexels-jahoo-867092-2_1.jpg.webp?itok=o7MUL1oO)

Advertise

Advertise