Quick guide to putting up a solar power plant in India

By Narasimhan SanthanamPost 2010, a demand slump following the abolition of feed-in-tariff policies in Italy & Germany caused a supply glut in global markets leading to a fire-sale of solar modules. This, indeed, was the underlying cause for the succession of anti-dumping cases in the US & EU (and now India). Causing a 30-40% drop in solar PV system prices (an all-time low), this, perhaps, accelerated deployment, if anything, in India. The solar market boom had begun.

India has seen a remarkable growth in solar capacity addition over the last couple of years. Indeed, from 3 MW in December, 2010, the installed capacity is now in excess of 1200 MW. Installations are poised to continue in the same vein with more than 2000 MW looking to be added under the National Solar Mission alone by 2017. In addition, various state governments have come out with aggressive policies which could result in another 7000-8000 MW of capacity additions across the country over the next three years.

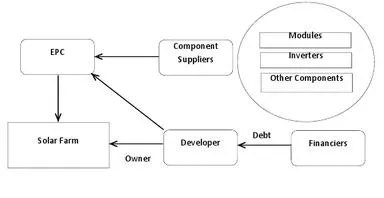

A look at all the entities involved in putting up a solar power plant (Figure 1).

Component manufacturers’ margins were thinning owing to the price crash and profitability was low, if not non-existent but new policies were being promulgated and capacities were being added at a feverish pace, especially in Gujarat. The Indian market witnessed a rise in service solution providers, specifically EPCs.

The solar PV EPC space, today, is a crowded market. Be it erstwhile pure module manufacturers like Moser Baer, Tata Solar, First Solar, Bosch and the like; power industry giants like ABB, Schneider Electric;similar solution providers in foreign markets like Ravano Green poweror greenfield companies like Aeon Renewable, Zynergy and so on, the industry has seen a massive influx of system integrators enter the fray. Low barriers to entry, a flurry of capacity addition announcements, freefalling system component costs along with the search for profitability in this sector, among many other possible reasons, could have been what prompted the stampede. Whatever the reason, it is safe to say that for anyone looking to install a solar farm, there is no dearth of companies to go to.

So how, then, do developers decide which EPC to go with? There are a variety of factors that have influenced developers’ decisions to go with a particular EPC in the past.

Price

India is a price-sensitive market. This fact holds good for the solar industry as it does for most others. For developers putting up solar farms for accelerated depreciation benefits or “higher returns”, a cheap turnkey offering makes the cut. However, it is well known that good prices do not always translate into good quality.

Brand, Track Record & Credibility

Indeed, this seems to be one of the biggest factors influencing developers’ decisions. A solar unit is expected to last for more than 20 years and produce as many units of electricity it can at that! A lion’s share of the past installations in India has gone to strong players with credible track records such as Sterling & Wilson, Larsen & Toubro, Mahindra EPC and the like. A common trait that these companies share is installations of over 60 MW each, the highest in the country. Consequently, their brand value has gone up and plays on the developers’ minds while choosing.

Ease of Financing& Risk Mitigation

Banking & financial institutions are wary about financing Solar PV projects, partly, due to the fact that it is an emerging industry in India and perceived risks remain significantly high. From the financier’s perspective, going with a credible EPC mitigates some of these risks. For the developers, going with a credible EPC to the bank might lower the cost of borrowing directly translating to higher returns on the project. At the same time, the perceived risk on the developer’s part is also minimized.

Value-added services

With so many new entrants into the market, EPCs have recognized the need to differentiate their offerings, attempting to provide many value-added services in addition to the traditional offerings. This could vary from providing land & evacuation support, aid in approval processes to offering O&M support services.

At this point, the developers’ biggest concerns (shared by the financiers’) are those of risks and their mitigation while a crucial value addition that EPCs could make is bringing in a financier. Very few banks have come forward to finance solar projects as a result of these unknowns. There is a necessity to bridge the information gap in order to pave the way for the future.

This is one of the primary motives behind the Renewable energy Exhibition, & Conference that TEDA is organizing on May 9-11 in Chennai Trade Center, Nandambakkam – RENERGY2013. Out of 250 exhibitors, almost 80% of exhibitors are from the Solar Sector.

The Conference also features several solar workshops (Covering rooftops, grid-connected, and solar products) for who would like to get down to the basic components and practical aspects of implementing and using solar technologies. These workshops ensure that those interested in entering this field or upgrading their knowledge has a very firm grasp of the fundamentals of Solar PV implementation.

Renergy 2012 which was organized by TEDA last year became the largest renewable energy conference, with over 1400 delegates attending the 2 day event.

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

![Cross Domain [SBR + ABR]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/pexels-jahoo-867092-2_1.jpg.webp?itok=o7MUL1oO)

Advertise

Advertise