Feature

What you need to know about Asian energy industry from IEA's former Executive Director Nobuo Tanaka

What you need to know about Asian energy industry from IEA's former Executive Director Nobuo Tanaka

The nuclear crisis in Fukushima has triggered a major review of the energy landscape not only in Japan, but globally. What do you think would be the eventual impact on the global energy mix?

Singapore economy fuels electricity trading value

National Electric Market of Singapore released its report on its record-breaking performance in 2010. In this light, the power generation sector is increasing the utilisation of plant technologies to achieve Singapore’s drive for energy efficiency.

Measurement solutions for safety, efficiency and environmental compliance in coal burning power plants

Richard Gagg, Derek Stuart and Randy Hauer of AMETEK Process & Analytical Instruments review the latest technologies available for monitoring various essential operations in coal-fired power generation.

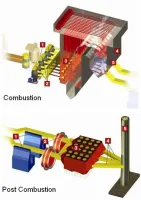

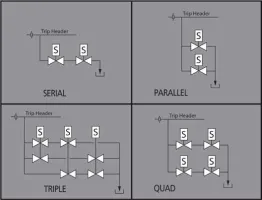

Experts’ approach to turbine safety

Jim Jacoby, Tri-Sen’s Vice-President of Marketing, shares about turbine safety, the technical improvements that need to be considered, and what can be done to maximise safety benefits.

Chromalloy notches up success in Asia’s turbine repair and maintainence market

Glasgow may be a long way from Bangkok, but when it comes to keeping Thailand’s International airport powered up and running, the link is a vital piece in the chain operated by Chromalloy, a world leader in gas turbine engine maintenance and monitoring.

Changing power industry landscape: Performance and reliability matter more than ever

With rising demands on renewable energy, there is going to be increasing focus on the wind power sector. In the last couple of years wind has become the preferred source of renewable power. While low capacity factor and power quality issues continue to be a challenge for operators, wind has become more competitive getting them a step closer to be commercially viable without incentives. This is mainly driven by huge growth in volume and entry of new OEMs, especially from China.

Upgrade the control system to give new life to old gas turbines

Gas turbines remain at the forefront of the power generation market, with a great variety available for the end-user in terms of unit size and fuel types.

An improved energy mix for China

According to China’s National Energy Administration (NEA), the country is likely to continue reducing investment into coal fired power plants as the lower than normal economy may result in a power glut this year. However, with the future in mind, China will build more nuclear reactors and wind farms to improve its energy mix.

In the winds of profit

A village near the northern tip of Japan's main island is the proving ground for a 5-meter-high (16- foot) bank of batteries built by NGK Insulators Ltd., the Japanese industrial-ceramics maker that may be the world's cheapest wind-energy play.

Tata’s tornado

Indonesia may be known as ‘The land below the wind', but for foreign players in the power market, conditions are about to get a whole lot stormier. Tata Power may well be headed directly into the storm if Indonesia's energy minister, Purnomo Yusgiantoro, carries through on his plans to renegotiate coal contracts with its overseas buyers, which could lead to higher royalty payments. Indonesia is the world's largest producer of thermal coal, and thermal coal is used to produce almost 70% of the total electricity output in India. Like many other Indian and Chinese power companies, Tata has acquired significant stakes in a number of mining interests in Indonesia: last year, it bought 30% stake in PT Kaltim Prima Coal and PT Arutmin Indonesia for $1.3 billion. And as demand for power intensifies back home, in the face of rapidly advancing coal prices, they are keen to increase extraction.

Electricity sector in India

Last issue we examined the inefficiencies in the electricity sector in India and concluded that there could be a potential to save a staggering USD 26 Billion every year. That money can be channeled into investments to generate growth which can easily add a few percentage points to the GDP. We also observed that most of those inefficiencies are in the distribution end of the electricity value chain. This month we would examine the specific problems that afflict the Distribution Sector. Over the past five odd decades the technical and commercial losses have continuously crept up. Soon, most electricity utilities in the country could not recover enough money from end user to even fully pay for the electricity that their customers required. That hit payments to generators and finally the fuel suppliers. Tarriffs were raised and state Governments chipped in with large subsidies. That in turn strained the Government's exchequer. Investments into building adequate generation, transmission and distribution infrastructure slowed down. New investors putting up generation capacities asked for and got sovereign guarantees for electricity sales to the electricity distributors. With such intensive Government involvement it was but natural for the sector to get highly politicized.

The case for power rentals in Asia

The rapidly developing economies of Asia are fuelling a constant need for fresh supplies of power to cure the energy shortfall problems being faced by utilities and all forms of industries and large building projects. This increasing need for power in Asia is being driven by industrial growth and people's improving living standards. These urgent demands for power mean that the power users and producers are being faced with critical decisions about what power generation solutions will satisfy their energy demands.

The low down on lindia's electricity sector

India is home to almost one sixth of the world's population. Over the past decade and a half the country has shrugged off its socialist stance and has veered right of centre, simultaneously opening up to the outside world. The service sector was first off the block offering to the world hitherto little known Indian service skills at unbeatable costs. Manufacturing and agriculture took a little more time to get going since that's a direct result of investments which takes its own time to implement. Finally the financial sector started attracting international interest partly because of the attractive investment potentials and partly because sweeping policy and legislative reforms ushered in transparency and stability. Living in the 90's In the early ‘90s when India started to change there was much consternation in abandoning the protective, inward-looking mould while the rest of the world was rapidly making borders fuzzy and integrating into one big global community. Fortunately a majority of the policy makers believed in what George Bernard Shaw had so eloquently articulated "The reasonable man adapts himself to the world; the unreasonable one persists in trying to adapt the world to himself. Therefore all progress depends on the unreasonable man." Fifteen years on, a country of a billion people is clocking a GDP growth of more than 8.5% and has finally broken into the league of top ten economies with USD 950 Billion recorded in the last fiscal year. A key pre-condition of that economic activity is adequate availability of electricity. A flawed electricity sector It is becoming increasingly clear that inadequacies in the electricity sector could become the major stumbling block of this fabulous growth story. This four part article will attempt to explore what is wrong and what needs to be done to align the electricity sector with vibrant efficiency being seen elsewhere. Lets have a quick look at electricity generation statistics. Installed capacity is 135 GW delivering 689,570 GWH of energy per year at an average load factor of 58%. The estimated gap between peak demand and availability is 20 GW and the energy shortfall is 48,270 GWH. Most of that gap is being met through highly inefficient and expensive liquid fired captive generation which falls under the unorganized sector. Correct data is not available about captive generation being used all over the country. The only reasonably accurate estimate is derived by working backwards from the projected shortfall and the assumption that most of the demand is actually being met through captive generation. It would be reasonable to assume that it costs US 25 Cents to generate a kWH of electricity by using diesel in small DG sets. Compare that with US 6 Cents per kWH for generating electricity from large coal-based or hydro plants. India therefore has the potential to save an amazing USD 9 Billion per year if only efficient generating capacities keep pace with growing demand. That's the first area of inefficiency. In India the T&D losses are reported at 35%. Meaning that out of the 689,570 GWH of energy being sent out by the generating plant, utilities manage to bill their customers for only 448,220 GWH. Technical losses should be 10% at the most. Many countries regularly achieve less than that. This means 25% of the energy is being used without anybody paying for it. That financial loss is being compensated by those who actually pay for the electricity through higher tariff or through Government subsidy. When it comes to subsidy, it can either take the form of direct payment to the loss-making utility or through less than optimum valuation of natural resource like coal and water used for generating the electricity. At a conservative retail tariff of US 10 Cents per kWH, the 25% of avoidable T&D loss represents a staggering loss of USD 17 Billion every year to the country's economy. This is the second area of inefficiency. Taken together, an estimated USD 26 Billion of expenditure can be curtailed for diversion into productive investment every year. It is generally accepted that investments into the service sector yields annual outputs of at least ten times and in the manufacturing sector the annual output would at least be the same as that of the initial investment. Assuming a very reasonable factor of two, the savings potential of USD 26 Billion per annum can yield a GDP of USD 52 Billion thereby setting the stage for an additional growth of 5%. Mind you, we are not talking here of finding new money for new investments. Rather by making the domestic electricity sector as efficient as it is elsewhere in the world, we would be able to automatically convert avoided expenditure into investible resource. So, what is Indian doing about it? India's power solution The most obvious solution is massive expansion of generating capacity. That's a fairly simple and straight forward activity but it comes with three pre-conditions. Sorting out infrastructural issues like land, road and rail linkages can prove to be daunting. Nationally-owned resources like coal, oil, gas and water have to be made available at benchmarked costs. The investors must be assured of payments against the supplied electricity. Of late considerable pragmatism has been demonstrated by the Government to sort out the first two problems. But the last issue is tricky. The accepted solution is a Power Purchase Agreement (PPA) between supplier and a buyer with a P&L Account healthy enough for commercial banks to guarantee payments. In India, most of the electricity distributors have negative bottom lines. Thus they are unable to offer a commercially bankable PPA. For many of the large projects, this issue has been settled by extending sovereign guarantee for payments against the supplied electricity. So far India has managed to plan for total installed capacity of 207 GW by 2012, hoping to add 72 GW of new capacities over the next four years. Capacity is expected to be 800 GW by 2030. But it is obvious that sovereign guarantees can not be handed out indefinitely. That's why the electricity distribution sector has to be quickly reformed to make it efficient. Next month we will examine what is happening on distribution reforms in India.

Ma Welcomes the dawning of a new era for Taiwan's Power sector

It may already feel like ancient history, but the soon-to-be-ended office of Taiwan's former President, Chen-Shui Ban, was witness to one of the most turbulent times in Taiwan's recent history. Chen's presidency was typified by frosty relations with mainland China, which included daily missile threats and political propaganda. Taiwan's power sector also became a victim of Chen's presidency as the island's power plants suffered from swelling power demands and market fluctuations. Despite intergalactic scuffles reminiscient of a page from a Star Wars film script, the cross-strait relations saga seems to be drawing to a close with Taiwan declaring the Kuomintang's Ma Ying-jeou as President. During his race for the presidency, Ma signalled a dramatic policy shift for Taiwan by announcing his intention to boost Taiwan's cross-strait relations with China. The Kuomintang's stunning election victory on March 22nd, marked a key milestone in cross-strait relations, but is Ma the man to patch things up and lift Taiwan's power sector from the doldrums? Taiwan's power sector is in the doldrums due to high power demands, a reliance on imports, fluctuating energy prices, economic red-tape, icy cross-strait relations with mainland China and the legacy of former President Chen Shui-Ban. Taiwan's power struggle Taipei 101 is struggling to live up to its job description as the night-light of Taipei as Taiwan's grid battles to cope with its dwindling electricity resources and escalating power demands. Taipower, as the sole grid operator pumps 75 percent of the island's electricity into Taiwanese homes, sustaining the lifestyles of 23 million people island-wide. In early 2008, during the term of former President Chen Shui-Ban, Taiwan's government failed to process a series of power plant permits due to applicants demanding inflated prices, which the state-owned Taipower subsequently refused to pay. "The problem isn't in us but in the companies, the prices they ask for are too high," said Clint Chou, a spokesperson from Taipower. However, if the bidders succeeded in getting permits from the government, they would have been tasked to build power plants and sell electricity to Taipower. Taiwan's escalating power demand took a turn for the worse this year, climbing to a record high and decreasing spare capacity at peak demand times to 5.13%, a percentage which was well below the government's goal of 16 percent. Taiwan's power sector is made up of an eclectic mix of energy sources including 55% coal, 18% nuclear, 17% natural gas, 5% oil and 5% renewable energy. But, the island's unhealthy reliance on oil and gas imports is making Taiwan increasingly sensitive to energy price fluctuations. In terms of this alarming trend, Taiwan's government is taking the proactive approach by pushing for 10% of its energy resources to come from renewables by 2010, thus doubling its current quota of 5%. But, the long list of problems facing Taiwan's power scenario begs the question, will Taiwan cope with its swelling power demand and put its besieged power sector back on-line? The resurgence of Taiwan's power sector seems to be taking shape with the introduction of new developments in the realms of wind, solar and nuclear power. Taiwan has an embarrassment of riches in terms of wind power resources, with huge on-shore and in particular off-shore capabilities. Taiwan is in the process of installing a number of American and German built wind farms on the island. Solar power is beginning to show some promise as a new energy source for Taiwan's power sector and is likely to add a key element to its growing mix of renewables, which makes up 5% of its energy sources. Nuclear power is the star of the show in Taiwan's bold new energy mix and is the leading energy source in Taiwan's plans for the future of its power sector. Taipower currently operates three nuclear power stations in Taiwan, with a fourth nuclear power station due for completion in 2009. It's not easy being green "It's not easy being green" may be the catchcry of Kermit on the children's programme Sesame Street, but Taiwan's power sector it seems is thinking the same thing. Taiwan's ecosystem suffers from a dearth of pollution problems due to its high population density and smog-producing factories and vehicles in cities including Taipei, Tainan and Lin Yuan. Water pollution is still a serious issue for the island's ecosystem with up to 90% of Taiwan's sewage being dumped into its waterways. Starting to feel the pinch from Taiwan's substantial pollution problems, the government introduced the mandatory use of unleaded petrol and started the Environmental Pollution Agency to ease the environmental pain. The decline in soil pollution and waste disposal proves that there are some positives for Taiwan's ecosystem. Soil pollution has been reduced by the removal of heavy industry and waste disposal looks to be a thing of the past with the advent of Taiwan's recycling move ment. Fuelling Taiwan's comeback Taiwan's liquified natural gas imports look set to increase by as much as 43 percent this year, helping to relieve the stress caused by Taiwan's surging power demands. "Natural gas imports have gone from an oversupply to a shortfall," said Jane Liao, General Manager of CPC Corp, who is planning to increase its gasoline prices by NT$2.4 (8 cents) per litre. In order to meet the challenges of Taiwan's surging fuel costs, Taipower is planning to raise its prices by as early as June 2008, marking its second increase in 25 years. Taipower is required to boost its tariffs by as much as 48 percent this year, due to surging fuel costs and electricity prices, if it fails to do this it will record a loss of NT$130 billion ($4.3 billion). Taipower has plans to seek government approval for the tariff increase after Ma takes office on the 20th May. Should this tariff increase be appproved, it will mark a sign of things to come for Taiwan under Ma's new government. Since his March 22nd election victory, Ma has been speaking on a platform of bold policy initiatives, including the scrapping of fuel-price caps, the expansion of nuclear power and the inclusion of an energy tax. Ma, in a radical new plan, wants Taiwan to rely on nuclear stations for 20 percent of Taiwan's electricity, a move which could significantly reduce Taiwan's emissions. "Under the principle of saving energy and reducing carbon-dioxide, nuclear energy may be an inevitable choice," said Kuomintang's economic advisor, Steve Hsieh. Ma's new way of thinking is becoming popular in Taiwan, considering former President Chen's strategy to phase out nuclear power as a result of government scare campaigns about radioactive waste. In 2050, Taiwan's carbon dioxide emissions are predicted to drop to as low as 50 percent of its 2000 levels. In January 2008, coal contributed 46 percent to Taiwan's electricity mix, in comparison to the 23 percent sourced from Taipower's nuclear power stations. While nuclear power is the way of the future for Taiwan's growing power sector, it will only account for 5 percent of Taiwan's total power capacity by 2025. However, the portion of coal-fired power could rise to as much as 50 percent. Kuomintang returns power The spirit of Chiang Kai-Shek seems to be alive and well in the new-look Kuomintang, but can Ma learn from the teachings of the Kuomintang's legendary sage and bring balance to Taiwan's power sector? Ma's decisive March election victory marked a key milestone in the resurgence of Taiwan's power sector. Ma's radical policies look set to revolutionise Taiwan's power sector through a decrease in red-tape via the liberalisation of the power sector and an increase in potential investment from the mainland. Should Taiwan at last bridge this cross-straits gap, Taiwan's power sector will stand to benefit from mainland China's extraordinary potential and economic growth. "The KMT's promised policy agenda could introduce favourable economic and geopolitical dynamics in the next four years," said Aninda Mitra, VP/Senior Analyst from Moody's Sovereign Risk Unit. However, Ma seems to be in a difficult position as he must learn to balance Taiwan's economic prospects with mainland China and the defence of Taiwan's de-facto state of sovereignty. Since the Communists expelled the Kuomintang in 1949, Taiwan's Republic and China's PRC have battled over claims to Taiwan's sovereignty. "There's only one China in the world and Taiwan is an inalienable part of Chinese territory," said Qin Gang, spokesperson of the Chinese Foreign Ministry. However, Ma's exciting blueprint for Taiwan's future looks destined to boost cross-strait relations and bring Taiwan's power sector back from the brink.

Electricity sector in India - Part2

Last issue we examined the inefficiencies in the electricity sector in India and concluded that there could be a potential to save a staggering USD 26 Billion every year. That money can be channeled into investments to generate growth which can easily add a few percentage points to the GDP. We also observed that most of those inefficiencies are in the distribution end of the electricity value chain. This month we would examine the specific problems that afflict the Distribution Sector. Over the past five odd decades the technical and commercial losses have continuously crept up. Soon, most electricity utilities in the country could not recover enough money from end user to even fully pay for the electricity that their customers required. That hit payments to generators and finally the fuel suppliers. Tarriffs were raised and state Governments chipped in with large subsidies. That in turn strained the Government's exchequer. Investments into building adequate generation, transmission and distribution infrastructure slowed down. New investors putting up generation capacities asked for and got sovereign guarantees for electricity sales to the electricity distributors. With such intensive Government involvement it was but natural for the sector to get highly politicized.

Lighting up Macau in more ways than one

Companhia de Electricidade de Macau (CEM), which has lit up the lightbulbs in Territory of Macau for more than a century, and its CEO Franklin Willemyns speaks to Asian Power about CEM's strategies in battling rising fuel costs and increasing tariffs. Willemyns, is also the Chairman of 17th Conference of the Electric Power Supply Industry (CEPSI), which Macau hosts this year.

Ma welcomes the dawning of a new era for Taiwan’s power sector

Zhang Yimou's acclaimed Chinese film Hero starring Jet Li seems to have more to do with cross-straits relations than meets the eye. Yimou's use of the sensitive wording ‘Our Land' at the climax of Hero was widely criticised by Taiwanese academics and celebrities alike for what they say gives gravitas to the doctrine that Taiwan is still ruled by the People's Republic of China despite Chiang Kai-Shek's Kuomintang officially breaking away from the mainland in 1949 into what Taiwanese now know as the Republic of China.

Advertise

Advertise