Rystad Energy

Rystad Energy is an independent energy research and business intelligence company providing data, analytics and consultancy services to clients exposed to the energy industry across the globe.

See below for the Latest Rystad Energy News, Analysis, Profit Results, Share Price Information, and Commentary.

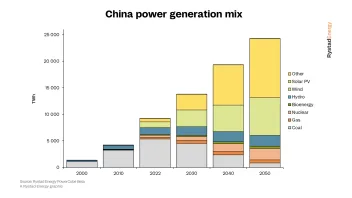

China’s renewables could grow up to 6,000GW by 2050

China’s renewables could grow up to 6,000GW by 2050

Power demand is projected to reach 13,600TWh by 2050.

Asia turns to coal amidst a global energy crisis

India and China are amongst the markets that have increased coal production for energy security.

LNG investments to reach $42b annually in 2024: report

This is 20 times the investments seen in 2020 which amounted to $2b.

Asia to lead solar PV recycling markets

It will be followed by North America and Europe.

What recycling solar PVs will be worth in the next decades

The market is currently valued at $170m.

Global energy security at risk as recoverable oil drops

Global recoverable oil is estimated at 1.57 trillion barrels, 9% down from last year.

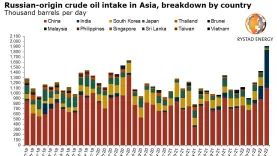

Asia overtakes Europe as key importer of seaborne Russian oil: report

India’s imports alone grew 658% against 2021 levels.

Offshore wind CAPEX in China to decline in next decade: report

Capital expenditure in the market is expected to drop to $7.7b in 2030.

Probe of solar imports from Southeast Asia may cost US 17.5GW new capacity

The probe involved imports from Cambodia, Malaysia, Thailand, and Vietnam.

Energy spending to hit record high of over $2t in 2022: report

This will be led largely by oil and gas, Rystad Energy projected.

Could phase-outs harm Asia’s nuclear energy growth?

The region is expected to bring 30GW in electricity per year with 32 reactors under construction.

Lockdowns, energy price hike could worsen China’s oil demand risks: report

Some 0.5 million bpd of oil consumption is at risk in case of a severe lockdown.

China drives rooftop solar growth: report

Installations increased to 27.3GW in 2021 from 19.4GW in 2017.

Renewable growth is grappling in South Korea

Could this be due to geographical barriers, prices, or the presidential elections?

Asia to bring bulk of battery demand by 2030

Demand from the region will account for 41% of the global market.

Asian coal prices surge as Russia conflict drive demand

Demand is anticipated as the market look to replace Russian supplies.

Ukraine-Russia conflict to hit Asian LNG

Spot prices are expected to be elevated, Rystad Energy said.

Advertise

Advertise